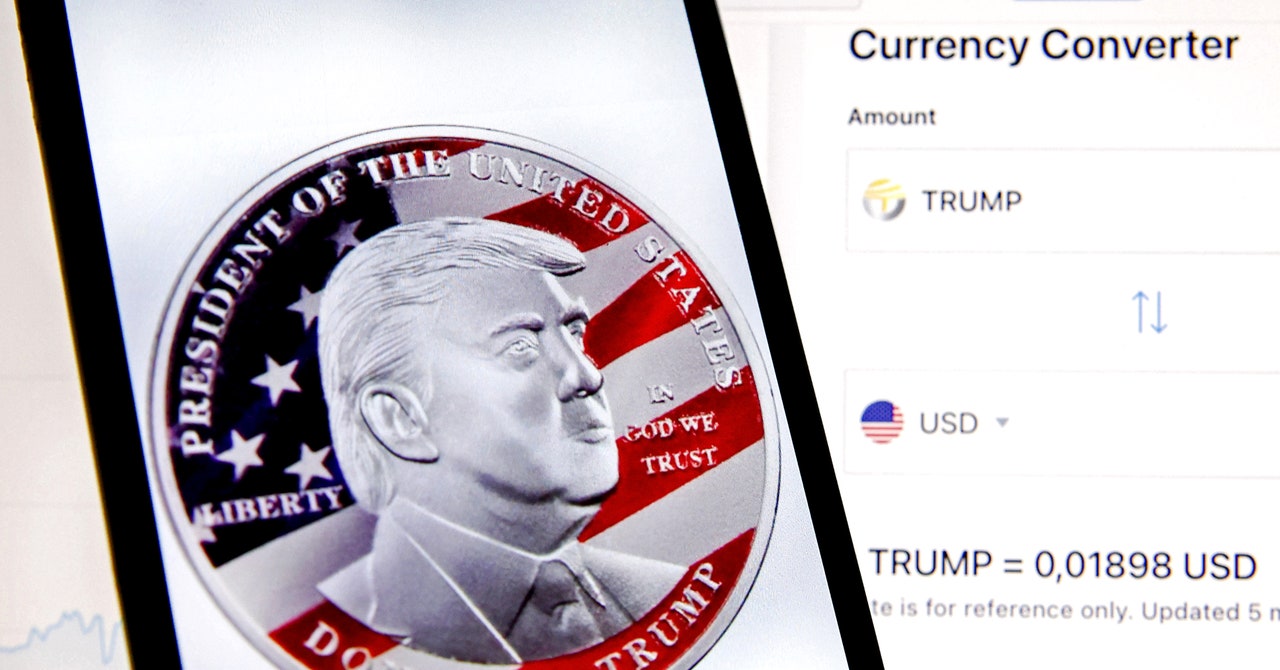

Crypto Wallet, who invests the largest amount in Trump, bought a large -scale coin on 18 January, the day it was launched, according to Nansen analysis. Meanwhile, the biggest return wallet on his Trump investment, meanwhile, had sold its holding to a large extent by 20 January, by that time the price had already collided with its peak. Trump's coins are now priced at $ 5.4 billion.

“You are the first you can bet. But if you have made a lot of condition, then it is not understood to stay for a long time, because it is not going to happen [the next] Apple or Nvidia, ”says Bartere. “There is zero value. So it's sure it is going to go down. ,

Between wallet Most beautiful profits From Trump, Nansen data shows, there are many who deal with comparatively small amounts, which means that some regular people managed to defeat the crowd in the same way as like big early traders. Between the high-value trades kept by J9TXV and others in minutes after the launch of Trump, there were armchairs traders 50 rupees throwing as 50 rupees,

Beyond an incredible stroke of Fortune and Bile, Sibanic and Power, only another principle can tell traders about plowing hundreds of thousands of dollars in Trump, so it was unveiled: it was unveiled: automated snipping bots to trades Was kept by

Powers say that snipping bots are usually programmed to snatch several different coins immediately after launch. Some wallets used to keep the initial high-value trump trades Tens are other memecoinsBut OtherInvolved J9txvThere are only a few.

“We will not expect to look from a bot, only a token would be acquired with a large position, especially if that token was not declared earlier. This activity seems very specific, ”says Power. “How do you codes the script for a bot, before you know it exists?”

Sibenic says that most snipping bots are also programmed to deal with small dollars. ,[The big early traders] Either as internal sources or any other party is more likely to have more explanation, especially invested in large amounts, ”says cibnic.

In the absence of any rule controlling memecoin in the US, it is not necessarily illegal to give initial notices to parties for an issuer.

Recently, many Federal lawsuit brought by investors It has been demanded to argue that Memcoins must come under Securities Acts, ruled by the Securities and Exchange Commission, a regulatory agency that works to protect American investors. But in an interview On 23 January, Venture Capitalist David Sachs appointed as America by Trump A and Crypto CaesarClaimed that memecoin should be considered as a type of collectable, an irregular asset class.

In an executive order signed on 23 January, Trump “established” a “established”Digital assets group“Which he tasked with appropriate crypto-related regulation and recommendation of law.

“The cryptocurrency industry is still running for clarity on regulation. Major players want to be seen as good confidence actors in financial markets, ”says Powers. “Some dissatisfaction is expressed [crypto] The industry offering this mimcoin seems to take advantage of the moment. ,

at the foot of Trump websiteA small-print disclaimer claims that Memcoin “is not intended to be an investment opportunity, investment contract, or any kind of security.” Terms and conditionsMeanwhile, determine that investors will have to forgive the right to bring a class action case regarding Memcoin. They also claim that investors are not entitled to the loss, even in the event of “misleading and inappropriate business practices” and “misinformed” Company.

“This is a surprising warning,” says Power. “What kind of waves and disclaimers will actually catch in court is another case. But installing the road with that attitude is not keeping in mind the hope of the Crypto industry to start the page on what came before. ,