In a landmark move aimed at standardising property valuation and taxation across the country, President William Ruto has signed the National Rating Bill(National Assembly Bill No. 55 of 2022) into law.

Accompanied by his Deputy Kithure Kindiki, and Land Cabinet Secretary Alice Wahome, Ruto signed the Bill into Law on Wednesday, December 2.

“The new legislation seeks to create a standardized framework for county governments to assess and impose rates on land and buildings. It also establishes mechanisms to enhance accountability in the use of revenues collected from these rates,” read part of the notice by the national assembly.

This transformative legislation introduces a comprehensive framework for assessing and imposing rates(taxes) on land and buildings across Kenya, promising greater accuracy, efficiency, and accountability in the management of county revenues.

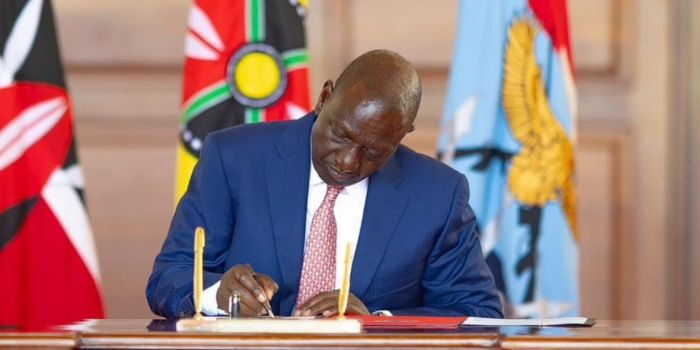

President William Ruto(Left) with Land CS Alice Wahome during the signing of the National Rating Bill into Law, December 4, 2024.

Photo

National Assembly

In the new law, the Office of the Chief Government Valuer has been tasked to oversee valuation processes nationwide and provide expert advisory services to county valuers.

Further, the Valuer is expected to formulate the National Rating Tribunal, comprising up to 15 members, to resolve disputes related to property valuation and rating.

This law, however, does not affect freehold agricultural land – land primarily used for farming and is owned outright by individuals. It focuses on urban and other rate-able properties.

Initially, the law was first passed by the National Assembly in October 2023. It was then amended by the Senate in June 2024.

After the amendment, a compromise version was agreed upon by both Houses in November 2024, which led to Ruto signing it into law on December 4.

The new law marks a significant shift from outdated practices, paving the way for fairer and more transparent property taxation.

“By doing so, it introduces modernized guidelines for property valuation and taxation, promoting equity and efficiency in revenue collection for counties,” the statement further revealed.

With the enactment of this new law, property owners can expect a more consistent and equitable approach to rate assessment across different counties.

CS Alice Wahome speaking during the opening of the Board of Registration for Architects and Quality Surveyors (BORAQS) seminar at Safari Park Hotel on Thursday, September 5.

Photo

Ministry of Lands