Stakeholders have raised debatable issues that could make life more difficult for Kenyans should the proposed Tax Laws and the Business Laws (Amendment) Bill sail through.

The stakeholders, in their submissions to the Finance Committee of the National Assembly on Wednesday, November 27, revealed that the tax bill did not clarify the anticipated effective dates of the taxes should they become laws.

Institute of Certified Public Accountants of Kenya (ICPAK) in its submission, urged the National Treasury to specify the dates for the implementation of the tax measures to eliminate ambiguity of the bill.

“Commencement dates are essential for both taxpayers and the Revenue Authority to ensure compliance is straightforward and remove any adoption-related ambiguity or disputes,” ICPAK recommended in its submissions.

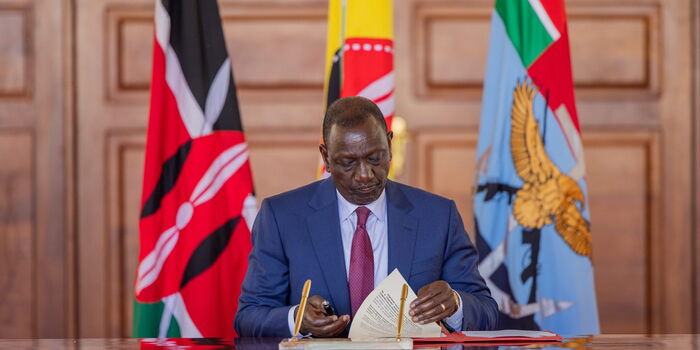

A photo of the National Assembly during the joint sitting address by President William Ruto on Thursday, November 21, 2024, in Nairobi.

PCS

The organisation also took a swipe at the government over plans to hike the excise duty on internet and telephone services from 15 per cent to 20 per cent.

According to ICPAK, the increase in telephone and internet rates would increase the cost of communication thus affecting businesses, and content creation where the youth are heavily engaged.

“With dwindling employment opportunities, why increase taxes on areas where the young people are earning?” ICPAK questioned the Finance Committee members.

Other sections of the Bills that attracted attention included the proposed imposition of withholding tax at 5 per cent and 20 per cent on payments made to resident and non-resident digital marketplace owners.

Digital traders who appeared before the committee argued that the withholding tax would push vendors away from e-commerce which would consequently have an impact on the revenue raising measures.

The Law Society of Kenya also raised concerns regarding the withholding tax and the proposed penalty of 10 per cent of the amount not withheld or remitted to the Kenya Revenue Authority (KRA).

The contested clause reads, “A person who is required under this section to withhold tax without reasonable cause fails to withhold the whole amount of the tax which should have been withheld or fails to remit the amount of the withheld tax to the Commissioner by the fifth working day after the deduction was made, shall be liable to a penalty of ten per cent of the amount not withheld or remitted.”

According to LSK, the provision does not clearly define what constitutes “reasonable cause” for failure to comply, which could lead to ambiguity in its enforcement and possible disputes.

During the stakeholder engagement, the law society urged the government to clarify the definition of ‘reasonable cause’ to provide clear guidelines for taxpayers оп what constitutes an acceptable reason for failing to withhold or remit tax.

President William Ruto, accompanied by Treasury CS John Mbadi at the Inua Biashara MSME Exhibition at the KICC in Nairobi on October 17, 2024. PHOTO/ William Ruto